Seven Trends to Watch for in 2025

Type in “2025 predictions” in a preferred search engine and the screen will immediately light up with an assortment of prognostications reaching across every corner of commerce, culture and society.

For accredited investors, the challenge is to sort through these digital tea leaves to find data-driven information that can be deployed when formulating a sound 2025 investment strategy.

What follows are seven trends Avestix will be watching as 2025 unfolds.

#1 Interest rates will likely continue dropping

JP Morgan Private Bank’s Outlook 2025: Building on Strength offers a comprehensive overview of global market trends. The complete 90+ page report is worth reading, but the bank's prediction about future interest rate cuts is noteworthy.

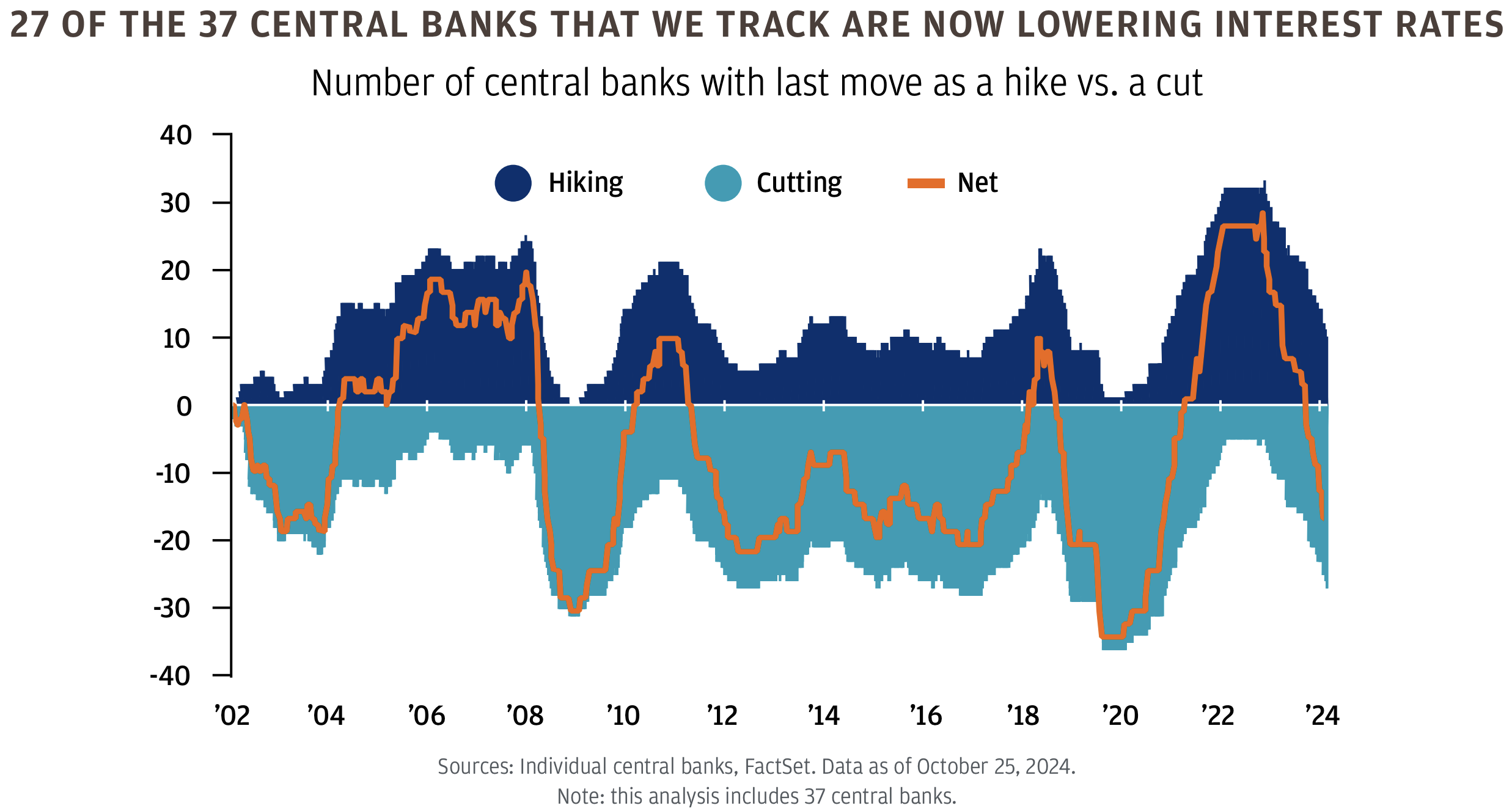

“Of the 37 global central banks that we track, 27 are cutting policy rates, including every G10 central bank outside of Japan,” says the report. “We believe policymakers will continue to nudge rates lower.”

How will lower interest rates affect the economy? JP Morgan believes, at best, future cuts could have a “muted impact” on economic conditions, but “[we] don’t think it will spark a surge in borrowing that pushes growth and inflation to an above-trend rate.”

#2 Homeownership in the U.S. will remain elusive

JP Morgan Bank’s prediction that rate cuts will only have a “muted impact” may be why the bank offers this grim assessment of the U.S. housing market going forward:

“Demand for housing far exceeds available supply. We estimate that the shortage of new homes … is between 2 million and 2.5 million units,” says the report. Additionally, "damages from more frequent and extreme weather, combined with inadequate and unaffordable flood and fire insurance,” will continue to make homeownership inaccessible for many.

In order for many prospective homebuyers to qualify for a new home, JP Morgan says interest rates would need to plunge to 3 percent or wages would have to increase for “almost nine consecutive years.” Even then, says the bank, it may be the end of the decade before affordable housing is once again available in many U.S. cities.

#3 Commercial real estate poised for a comeback?

The commercial real estate (CRE) market, on the other hand, appears to be poised for a comeback in 2025, at least according to many of the 880 CRE executives Deloitte recently surveyed. Eighty-eight percent say they “expect their company’s revenues to increase going forward,” a far more optimistic outlook than was reflected a year prior when 60 percent of respondents told Deloitte they anticipated revenue declines.

“While their companies may be coming off muted baseline financial performances across the real estate industry last year, the turn in revenue sentiment could indicate that global real estate executives expect better prospects ahead,” says Deloitte.

#4 Energy usage spikes as AI becomes ubiquitous

In October, Ash Aly, Avestix’s chief technology officer, said that tech companies are under increasing pressure to build “advanced facilities capable of supporting the intense data demands that artificial intelligence (AI) has created.” Looking ahead to 2025, Deloitte says AI will be the driver behind record-high electricity usage, eventually culminating in 2030 with AI-driven power usage doubling, accounting for 4 percent of all global energy consumption.

#5 U.S. women will achieve ‘AI parity’ in 2025

While Deloitte says AI will result in record levels of energy consumption, the firm also believes AI ubiquity will make 2025 the year that U.S. women catch up to their male counterparts when it comes to deploying GenAI.

Whereas in 2023, about twice as many men used GenAI compared to women, the “experimentation and usage of GenAI by women will equal or exceed that of men in the U.S. by the end of 2025,” says Deloitte.

#6 Women Entrepreneurs will outpace men in AI adoption

The pace at which women are embracing AI is especially strong among entrepreneurs, according to Ernst & Young (EY). While nearly three-quarters of the 500 entrepreneurs EY surveyed say are optimistic about AI, believing its positives outweigh any negatives, that optimism was especially strong among the women surveyed.

EY’s 2025 Entrepreneur Ecosystem Barometer determined that 45 percent of the women respondents have already “established AI systems and that their teams are fluent in their use,” surpassing the survey average of 36 percent. Women told EY that — if given one extra hour each day — 50 percent would use the time to learn more about new technologies like AI or machine learning, compared to 41 percent of the total respondents.

#7 Blockchain will continue to gain mainstream traction

Number one on Thomson Reuters’ list of Four major fintech trends for 2025 is the prediction that blockchain technology is finally “heading for the mainstream.” Nevermind that tech gurus have been predicting this since at least 2014; Thomson Reuters believes 2025 will be the year because blockchain is set to “underpin more and more of their financial transactions, as the traditional finance world … starts to embrace decentralized finance (DeFi), opening them up to cryptocurrency transactions and more.”

Among its leading mainstream use cases the media company identifies: helping meet banking AML and KYC requirements, asset tokenization and deployment of smart contracts.

Are you interested in including commercial real estate, AI, blockchain, or women-led companies in your 2025 investment strategy? Avestix offers investment opportunities in each of these areas and more. Contact Avestix today.